AMD Stock Set To Rage Amid Ethereum Mining Demand Goes High

Advanced Micro Devices (NASDAQ: AMD) is the key semiconductor company in shaping modern computing technology for the next decades. Obviously, AMD stock is having steady growth due to crystal clarity of road map execution for the last 5 years. Back in 2015, AMD stock was sitting around $1.80 per share and now it’s a king of long term investors by gaining nearly 1700% growth. Main growth drivers of AMD are Processors for servers and general consumers, professional and consumer Graphics Cards or GPUs (Graphics Processing Unit), Custom Console Chips like APU (Accelerated Processing Unit) for Sony and Microsoft, and embedded solutions for enterprise.

Just 3 years back, Ethereum cryptocurrency was looming on bandwagon effect caused by newcomers (investors) and GPU miners. Unique AMD Radeon GPU architecture has allowed Ethereum miners to increase calculations per second (hashrate) by 40% and decrease power consumption by 25%. Secret sauce behind these features is memory controller tweaking in BIOS, thanks to Open Source Hardware standard embraced by AMD where general consumer is able to modify performance according to real-world gains. Best selling GPUs of AMD were obviously RX 580 4GB/8GB and RX 570 4GB/8GB cards almost reaching 35 MH/s in ethereum mining and consuming 85W energy depending on successful modding or silicon lottery. Nowadays, both cards are outdated according to mining enthusiasts who claim that price, performance and power play the main role in mining ethash algorithm. Even latest ASIC miners from Bitmain or Inosilicon couldn’t keep up the performance per dollar efficiency as compared to latest Radeon RX 5700 XT and RX 5600 XT cards. As of now, with latest BIOS modding the RX 5700 series cards already reached up to 61 MH/s and little sibling RX 5600 XT can hit up to 46 MH/s.

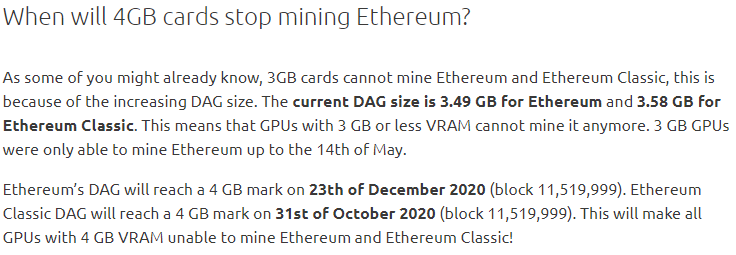

Most important, on 23 of December, according Nicehash administrators, Ethereum proof of work algorithm Ethash will make 4GB GPUs obsolete by increasing DAG (Directed Acyclic Graph) over 4GB size thus making majority mining farms to switch onto 6GB or 8GB GPUs. Massive exodus of 4GB miners is expected to embrace 8GB cards for future proofing their businesses. In comparison, Nvidia RTX GPUs are continuously showing slow hashrate per price due to being closed source (proprietary) hardware that disallows BIOS tweaking. Prominent mining enthusiasts like Red Panda Mining and Bits Be Trippin’ YouTube channels firmly stated that Radeon RX 5700/5600 series GPUs with RDNA architecture have price to performance superiority over other counterparts.

AMD poised to reach new revenue heights in it’s history because GPU division brings more profit during cryptocurrency mining boom that set to begin this winter amid old 4GB GPUs are nearing to obsolescence. Invest in AMD stock on your own risk even though it’s looking to be promising in this tough times.